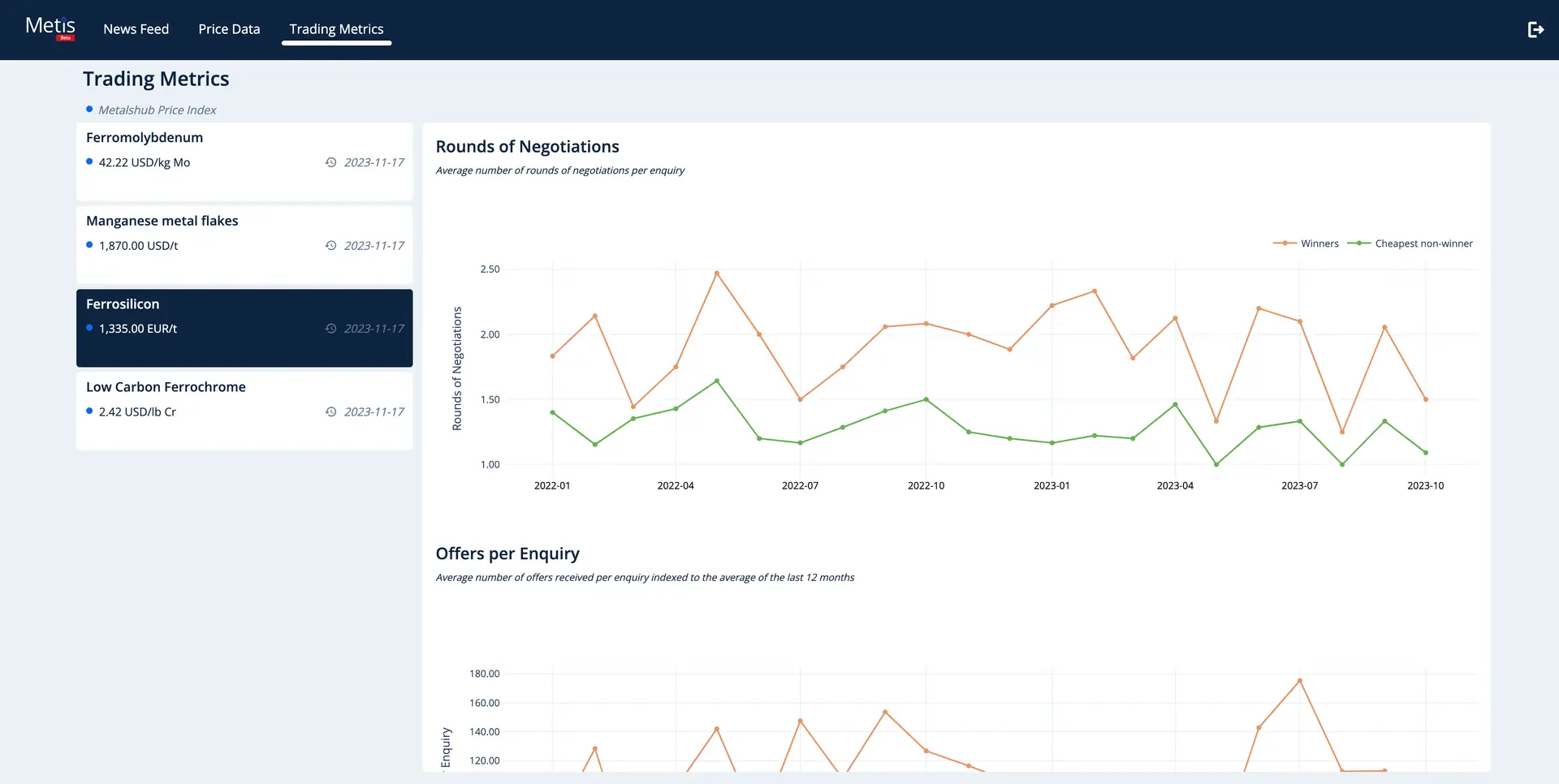

Trading Metrics

The valuable tool for assessing the market's current state and making the most informed, data-driven business decisions.

Automated and specific

Based on Metalshub data

Various indices reflecting the market developments and sentiments (i.e. demanded volume, rounds of negotiations, offers per enquiry, price reduction, price competition and volatility etc.) based solely on the trading data from the Metalshub platform.

The automated algorithm stands behind all trading metrics calculations.

Trading Metrics indices are the unique indicators for evaluating the specific commodity demand on Metalshub.

Metis provides the following Trading Metrics for selected ferroalloys in Europe:

Winner price reduction

The average price reduction per deal offered by the winner from the initial offer or starting point

Price volatility index

The average standard deviation of the prices in all negotiations during the month

Rounds of negotiation

The average number of negotiations (bids and offers) between buyer and seller per enquiry on Metalshub

Demand index

Monthly volume requested on Metalshub compared to the average volume of the last 12 months

Offers per enquiry

The average number of proposals received from independent suppliers per enquiry on Metalshub compared to the average number of the last 12 months

Would you like to discover more?

Our team would be delighted to consult you on our services!