In February, the bulk ferroalloys market was quiet, with no noticeable price fluctuations, as the month before. On the other hand, price speculation continued in the noble ferroalloys market, leading to a surge in molybdenum prices. By the end of February, however, quotations slightly receded.

Meanwhile, the dynamics of global steel production still need to be more encouraging. According to Worldsteel, carbon steel output fell 3% year on year to 145.3m tonnes in January. Only the Middle East (+19.7%) and China (+2.3%) were among the countries with favourable growth dynamics for the first time in six months. The world’s leading economies ended January with a marked decline. In the EU, steel production collapsed by 15.2% (Germany, in particular, by 10.2%) to 10.3m tonnes, and in North America – by 5.6%, to 9.1m tonnes.

However, market participants remain optimistic. Within recent months, several plants in Europe announced that they are restarting furnaces, which by the end of the current quarter may result in increased consumption of raw materials, including ferroalloys.

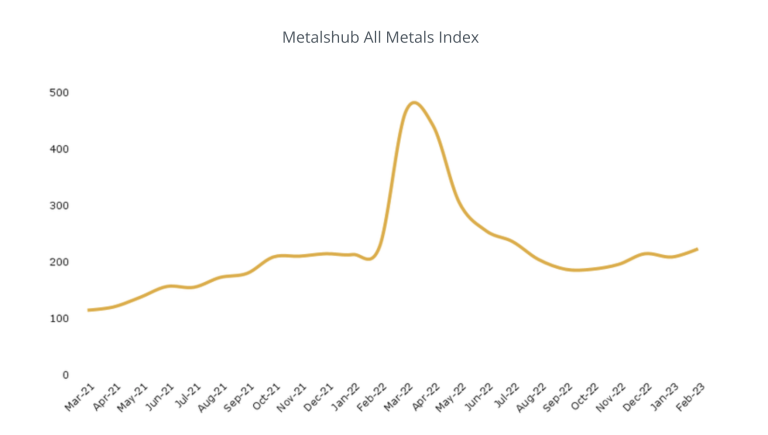

The Metis all metals index rose 15 points in February because of a rise in the price of noble ferroalloys. A seasonal recovery in demand in March-April is expected to support steel and raw material prices.