European metals markets remain in a shaky equilibrium.

Despite the macroeconomic risks, steel demand from the main sectors remains the same steel producers are not in a hurry to increase production.

They are concentrating on reducing inventories. The risk of a collapse of the energy market due to the urgent need to diversify energy sources in energy sources in Europe, triggered by Russian military aggression in Ukraine, appears to be less significant. However, an explosive demand recovery in this segment is not expected.

Ferromolybdenum

- After ferromolybdenum prices in Europe had fallen below 50

USD/kg Mo until the beginning of April, they are now rising again. - The European market is affected by supply bottlenecks – these are compensated by traders with quick deliveries from China and South Korea.

- Global molybdenum production fell by 1% last year; in

South America by as much as 8%. - The European molybdenum market is expected to remain volatile shortly, and prices will be subject to short-term speculation.

Ferrosilicon

- Further electricity price reductions in Europe will enable local producers to

restart ferrosilicon production. - The Slovakian OFZ plant has had a furnace back in operation since April 1. started up. Ferroglobe is also reportedly ramping up production again. Elkem performed maintenance work on the equipment in March and reduced its alloy production accordingly.

- Following a relative stabilisation of the security situation and despite the ongoing Ukrainian ferroalloy plant, Zaporizhzhya has started up three furnaces commissioned. Supply in Europe is not expected to be affected, as the plant mainly aims to meet domestic demand.

- Buyer demand remains subdued, which is preventing sellers from

preventing them from raising prices in stores. The spread between the offer price and the final price is still significant.

Ferrochrome

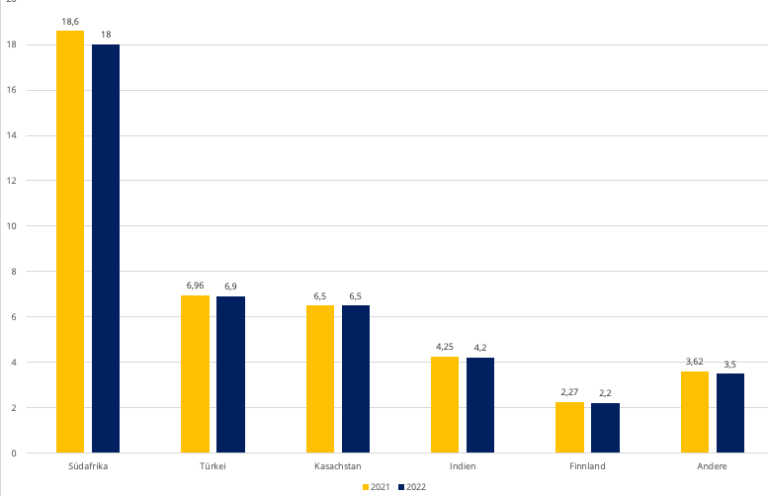

- According to Statista (4/14/2023), Turkey was the sixth largest chrome producer in 2021 after South Africa, Kazakhstan, India, Zimbabwe and Finland.

- The Turkish chromium industry is gradually recovering from the effects of the February earthquake. The country’s leading chrome producer, Yildirim Group, says it is ready to resume shipments through the port of Iskenderun.

- In light of the unfavourable macroeconomic conditions, all major

In April, stainless steel producers in China announced lower purchase prices for HC FeCr. - Ferrochrome prices in Europe fell by 15% to 30% in April as no supporting fundamentals existed.

Chromium production (mt) – five biggest countries 2021 vs 2022